With Facebook's one billion dollar acquisition of Instagram, I think many of us can agree that several startups are redefining what constitutes "value." This redefinition did not just happen this week with that one massive acquisition. Crazy-big valuations and expensive acquisitions are becoming increasingly common and many startups over the past several years appear to be following similar trends that are counterintuitive to classic business-think.

As an aspiring entrepreneur, I think it is vital to understand what is happening and how this new landscape may influence ideas for future ventures.

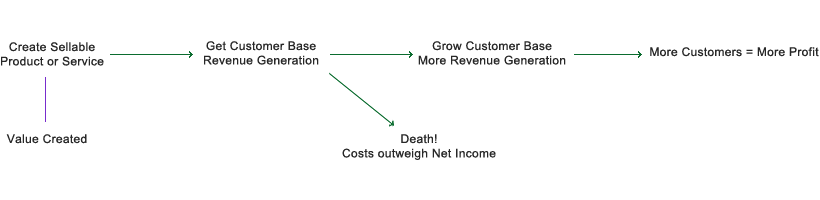

Traditionally, and still in probably every industry outside of startups, something with business value was something that directly generated money for the company. Pretty straightforward. Entrepreneurial ideas had a few basic criteria: identify something people wanted, produce a product or service that satisfied that want, and finally, sell it to people. This simple process of identifying, producing, and selling a good or service for cash was valuable.

The flowchart above is simplified but accurate. Notice how "value" is introduced at the beginning by creating something that can be sold, something that immediately generates revenue. Some new successful startup ideas have found an alternative criterion for creating value and for many people including myself, it is difficult to fully understand how it can work.

Several of the high-profile startups that we read about in TechCrunch have started using a new strategy for creating value: find something people want and will use, build that product or service, and attract a lot of users, offering the product for free. This is exactly what Instagram, Twitter, Path, Facebook, and others have done and it is working.

Initially, these companies are not selling anything. Their core products have no real revenue channels. Instead, they spend a lot of money developing something that lots of people love to use.

Here is where "value" became redefined. Traditionally, business value has been measured by the revenue generation of a good or service. Today, startups with tremendous "value" don't have to make money, they have to attract lots of people. Users have become the new basis for value in the startup world.

So why are millions of users so valuable? This question particularly pertains to startups with free products. Intuitively you'd think if a business doesn't generate revenue on a per-user basis, it wouldn't matter how many users they had. But it does matter. High-value startups that do not generate revenue are only valuable because of their large/growing user-base.

Yet all businesses have to generate positive cash flow eventually; startups are no exception. So the explanation for why users are so valuable has to be the projected future revenue opportunities that user-base offers. If you can't ever make money from users, there is no reason to have them or for the business to even exist.

It appears startups create value by attracting users because they can eventually try to monetize their business, generating cash flow and becoming a sustainable company. That is an interesting approach. If the startup can eventually monetize it's business model, should they not try to execute that asap, saving time and money? Why wait for so many users? One reason to wait might be a fear that users will abandon the product if they try too soon. But if attempting to generate revenue causes established users to flee and the startup cannot figure out how to make money off a reasonably sized user-base, did they ever create real value? Will the product ever be able to make money in its present form or will substantial changes be required? Will users stay loyal to the product after substantial changes?

The other most obvious outcome is for a startup to be acquired by a bigger fish. "They don't have to monetize it. They could just sell to a bigger company like Instagram did." That is true and probably the actual goal of a lot of startups. But something interesting would happen to the "value" the startup generated. Remember, a startup's value is based on their total users. During an acquisition, it is probable that some users will leave because: they don't care for the new parent company, they do not like the changes the parent company might make to the startup's original product, or users just prefer a substitute. Tons of people deleted their Instagram accounts within hours of the news of the Facebook acquisition. Users leave because startups offer an experience and relationship that larger companies don't usually match. So the startup value (user-base) will decrease in exchange for an increased chance at traditional business value (revenue opportunities). Startups must transform their business value over time.

I'm just trying to make an interesting observation. Startups are beginning to create a different kind of value but eventually that "value" has to change from startup value (lots of users) to traditional value (revenue generation). Again, no business can survive without making money. If too many young companies build their products purely around startup value with no future transition point towards traditional business value, their likelihood of longevity decreases. I think Instagram was an outlier, but not in a bad way. Whether or not you agree with me on that, I hope you can see how startups really have redefined "value."